- Home

- YOUR FUTURE

- Futurist Keynotes

- FUTURE EVENTS

- How Patrick Dixon will transform your event as a Futurist speaker

- How world-class Conference Speakers always change lives

- Keynote Speaker: 20 tests before booking ANY keynote speaker

- How to Deliver World Class Virtual Events and Keynotes

- 50 reasons for Patrick Dixon to give a Futurist Keynote at your event

- Futurist Keynote Speaker - what is a Futurist? How do they work?

- Keys to Accurate Forecasting - Futurist Keynote Speaker with 25 year track record

- Reserve / protect date for your event / keynote booking today

- Technical setup for Futurist Keynotes / Lectures / Your Event

- Dr Patrick Dixon MBE

- Futurist Books

- 18 books by Futurist P Dixon

- How AI Will Change Your Life

- The Future of Almost Everything

- SustainAgility - Green Tech

- Building a Better Business

- Futurewise - Futurist MegaTrends

- Genetic Revolution - BioTech

- The Truth about Westminster

- The Truth about Drugs

- The Truth about AIDS

- Island of Bolay - BioTech novel

- The Rising Price of Love

- Clients

- CONTACT for KEYNOTES

Patrick Dixon - Futurist Keynote Speaker "How AI Will Change Your Life" - BESTSELLER IN AIRPORTS FOR 12 MONTHS

29 Years Experience in Future Trends Forecasting >400 Global Clients - Every Industry and Region

How AI is transforming Pharma and health care. 10m lives a year will be saved. Keynote on health

The TRUTH about the FUTURE including AI - all major trends are VERY closely interlinked - AI keynote

How to use AI to stay ahead at work

Connect your brain into AI? Keynote speaker on AI and why emotion, passion and purpose really matter

THIS IS OUR FUTURE: 1bn children growing up fast, 85% in emerging markets. Futurist Keynote Speaker on global trends, advisor to over 400 of the world's largest corporations, often sharing platform with their CEOs at their most important global events

AI impact on pharma, medtech, biotech, health care innovation. Why AI will save 10m lives a year by 2035. Dr Patrick Dixon is a Physician and a Global Futurist Keynote Speaker, working with many of the world's largest health / AI companies

Most board debates about FUTURE are about TIMING, not events. Futurist Strategy Keynote speaker

Logistics Trends - thrive in chaos Seize opportunity with cash, agility and trust. Logistics Keynote

Future of Logistics - Logistics World Mexico City - keynote on logistics and supply chain management

Truth about AI and Sustainability - huge positive impact of AI on ESG UN goals, but energy consumed

AI will help a sustainable future - despite massive energy and water consumption. AI Keynote speaker

The TRUTH about AI. How AI will change your life - new AI book. BESTSELLER LIST AIRPORTS GLOBALLY - WH SMITHS FOR 12 MONTHs, beyond all the hype. Practical Guide by Futurist Keynote Speaker Patrick Dixon

How AI Will Change Your Life: author, AI keynote speaker Patrick Dixon, Heathrow Airport WH Smiths - has been in SMITHS BESTSELLER LIST FOR 12 MONTHs IN AIRPORTS AROUND WORLD

How AI will change your life - a Futurist's Guide to a Super-Smart World - Patrick Dixon - BESTSELLER 12 MONTHs. Global Keynote Speaker AI, Author 18 BOOKS, Europe's Leading Futurist, 28 year track record advising large multinationals. CALL +447768511390

How AI Will Change Your Life - A Futurist's Guide to a Super-Smart World - Patrick Dixon signs books and talks about key messages - future of AI, how AI will change us all, how to respond to AI in business, personal life, government. BESTSELLER BOOK

Future of Sales and Marketing in 2030: physical audience of 800 + 300 virtual at hybrid event. Digital marketing / AI, location marketing. How to create MAGIC in new marketing campaigns. Future of Marketing Keynote Speaker

TRUST is the most important thing you sell. Even more TRUE for every business because of AI. How to BUILD TRUST, win market share, retain contracts, gain customers. Future logistics and supply chain management. Futurist Keynote Speaker

Future of Artificial intelligence - discussion on AI opportunities and Artificial Intelligence threats. From AI predictions to Artificial Intelligence control of our world. What is the risk of AI destroying our world? Truth about Artificial Intelligence

How to make virtual keynotes more real and engaging - how I appeared as an "avatar" on stage when I broke my ankle and could not fly to give opening keynote on innovation in aviation for. ZAL event in Hamburg

"I'm doing a new book" - 60 seconds to make you smile. Most people care about making a difference, achieving great things, in a great team but are not interested in growth targets. Over 270,000 views of full leadership keynote for over 4000 executives

Future of Europe - Why EU is splitting into two regions

Futurist Keynote Speaker: Posts, Slides, Videos - Future Trends, Economy, Markets, Keynote Speaker

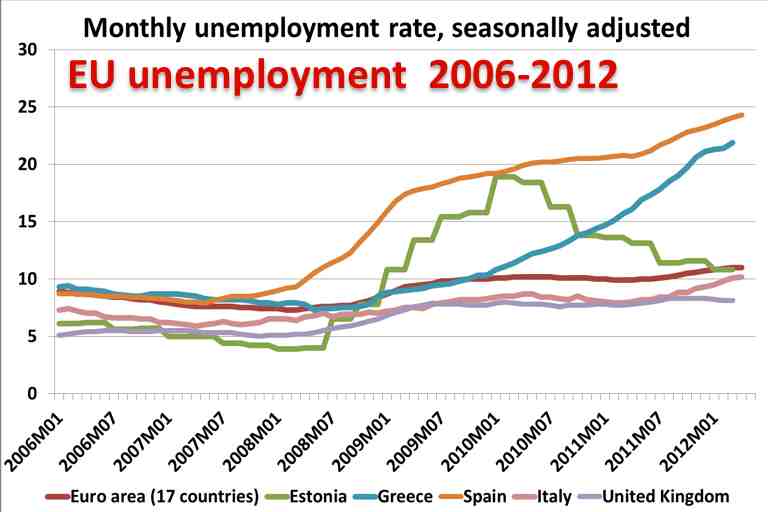

Countries like Estonia had their own crisis early and have recovered well, while countries like Germany and the UK have yet to experience a jobs crisis. Indeed, while the numbers out of work increased slightly in the UK, the total number of people in work has increased year on year, because the workforce has grown. One reason has been more people continuing to arrive in the UK from other EU nations, hoping to find work.

The UK job market has changed during the crisis, with rapid growth in numbers of people working part-time, especially in those over 50, many of whom have embraced the change as part of a new chapter in life.

With the age at which people are retiring getting older, and with more people needing to find some additional income after retirement, this pattern of older part-timers is set to continue.

However, countries like Spain have seen meteoric rises in unemployment, particularly among 18-15 year olds, where some areas are seeing jobless rates in excess of 40%.

Once again there are other factors going on when you peel below the surface. Family structures are very strong in Spain, and many young people are surviving by going to live with parents, helping out informally with family businesses and so on.

The informal economy has always been sizeable in Spain and it seems this sector may be growing rapidly as in Greece and Italy. What do you do to survive if your earnings are 25-40% down on last year, if you have had to swop a secure salary for informal part-time, temporary work? Once strategy is to keep the cash, don’t declare it, don't’ pay tax, and disappear from official statistics for people in work.

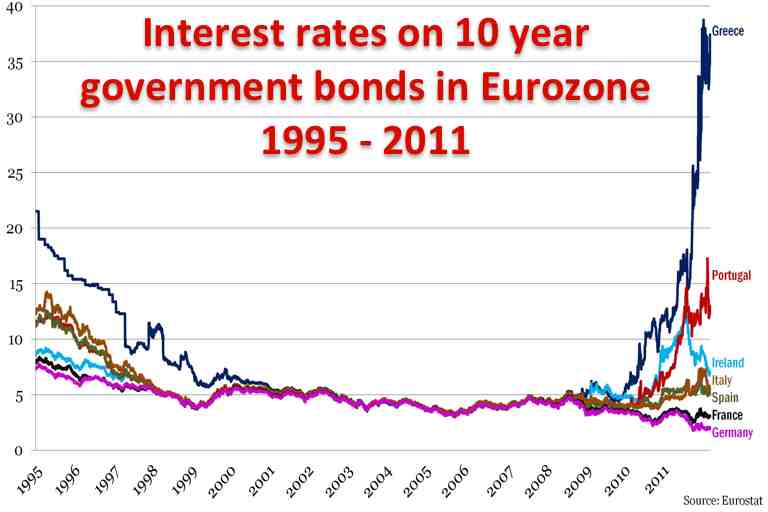

Another example of Two Europes is in the cost of borrowing – or rather the opinion of investors about the ability of your government to survive without defaulting on debts.

Just look at the differences in the rates for Greece, Portugal, Ireland, Italy and Germany.

What is important about this graph is the timescale, going back to 1995. You can see clearly how out of step these kind of interest rates are with anything in recent history.

But here again, there are other factors we need to understand. For a start, these interest rates are not being charged on all the government debt in – say - Greece. They are simply the rate that the government had to offer on that day, to persuade investors to save some additional money in the government’s private bank account for a fixed period of 10 years.

A decade is a long time in today’s world. The investor is being forced to take a bet on what the inflation rate will be. The difference between that and the interest rate offered will be the real return on their investment (assuming no default).

So ordinarily, investors would only demand an interest rate of almost 40% a year if they were convinced that inflation would be running on average at somewhere above 35%, which is clearly nonsense.

Investors are taking a bet, assuming that there is a very high risk that they will get none of their money back at all, or only some of it. And to insure against that risk, they want a risk premium. Of course, if Greece actually does limp along for a decade, and pays all that interest, and repays all that debt, the investor will have made a spectacular return.

The truth is that even with a “promise” from the Greek government of around 40% a year of interest, many investors are running scared. They just do not want to take the risk – at any price. Instead they have been pouring money into the bank accounts of governments like Germany and the UK, who have been overwhelmed by demand for their own bonds.

Germany has been able to get away with offering as little as 1-2%, which is less than current rates of inflation, meaning that investors are actively choosing to make a loss.

So Germany has been actively benefitting from fear of Greeks, Italians, Spaniards.

Can a country survive if the government has to pay over 20% a year on what it borrows? The answer is no, if inflation rate is a fraction of the interest rate, and if >20% rate is applied to all their borrowing.

However, it only applies to the new borrowing that government needs to make that month. It is as if a home owner has a mortgage for EU200,000, but it is divided into 20 loans of EU10,000 each, of which each loan comes up for renewal every 5 years, on a different month. So most months the home owner has to take out a new loan for around EU10-20,000 at the best rate he or she can get that month.

The problem for Greece and Italy is that so much of their piles of national debt all came up for refinancing at the time of the crisis. In comparison the UK government has been in a very comforting position, with most of £1 trillion of debt issued shortly before the crisis and not due to be renegotiated for some years.

So what does it all mean?

The underlying fact is that Greece has more debt than can possibly be repaid, even at zero interest rates. And every time it tries to repay debt, it does so out of more borrowings, or by cutting government spending, or by increasing taxation. All three of those strategies are useless as they make the underlying situation even worse, crippling the future of the country just as it is trying to recover.

Expect therefore that at some stage there will be a massive write off of most of the Greek debt. They may write it off because those who are owed the money realize it will never come back anyway, and writing off most of it means a little of the rest might just be repaid. Or the Greek government may take matters into their own hands, announce they are leaving the Euro and are not going to repay.

Would that be such a disaster? Many other nations have been in as bad a crisis or worse, over the last 20 years, and have recovered. In every case they did so in the same way. They allowed their currency to collapse, as investors sold out, and also refused to honor some government debts. The currency fell to a point where everything in the country started to look like a bargain and investors began pouring money back in again. The currency settled down at a lower level, making all exports cheaper, and imports more expensive, making life cheaper for tourists coming in, and for anyone from another nation wanting to buy property.

But Greece is locked into an unsustainable economic hell: because it is part of the Euro, it cannot depreciate the currency. Instead it is forced to have the same exchange rate as Germany and France.

What are your own views on the Future of Europe? Please do comment below.

| < Prev | Next > |

|---|

Newer news items:

- The Truth about Brexit - part 2 - what is likely to happen next and why, real impact likely to be very different than most expect. Why a second vote on Brexit is still a real possibility.

- Life after Brexit: why I was right about immediate impact of the Brexit vote and what next. Why Brexit impact on trade, services, visas, banks and retail sales will be less than many fear

- BUY MY NEW BOOK: The Future of Almost Everything - reprinted twice in last 4 months - or read FREE SAMPLE CHAPTER

- Huge Brexit shock to global economy? Truth about Brexit impact on UK, future of Europe, Eurozone, exchange rates, migration, business and wider world. Predictions written in 2016 and were very accurate. Futurist Keynote Speaker

- Forecasts I made re Brexit were correct: short term and long term. Impact on your personal life, house prices, brexit business strategy, community, EU and wider world. Cut through toxic nonsense. Keynote speaker on geopolitics and economy

- Can a Futurist REALLY predict the future? Here's loads of predictions I made over last 20+ years in 16 Futurist books and as a Futurist keynote speaker

- 5 reasons why every business needs to know about "The Future of Almost Everything" - my latest Futurist book. Discover your Future

- The Future of (Almost) Everything: Impact on Saudi Arabia economy and business. Global Competitiveness Forum - Saudi Arabia Futurist keynote for international investors - VIDEO

- 10 trends that will really DOMINATE our future - all predictable, changing slowly with huge future impact - based on book The Future of Almost Everything by world-renowned Futurist keynote speaker. Over 100,000 views of this post. Discover your future!

- The Future of Almost Everything - 6 Faces of the FUTURE CUBE. Futurist methodology - global trends video

- Future Trends - impact on Baltic Region and Wider World. Interview on Infotech, biotech, Crimea, possible breakup of UK, keys to business success

- Future of the Turkish Economy: Turkey economic outlook, growth, inflation. Futurist Speaker - VIDEO

- Future of Northern Ireland Economy - Growth Strategies

- China as world's dominant superpower - Impact on America, Russia and EU. Futurist keynote speaker on global economy, emerging markets, geopolitics and major market trends

- Truth about UK debt - hidden ways for government to reduce

Older news items:

- Truth about Global Economic Crisis: America, EU, China, Emerging Markets - Global Economy Keynote Speaker

- Future of Euro – and possible breakup of the EU / Eurozone. Futurist keynote speaker

- How interest rate policies will change: future inflation risks, global economy

- Making sense of the 2007-2015 economic crisis - what next? Look back from 2100 - VIDEO

- Future of Europe - strains and stresses, economy, eurozone

- Sustainable growth - happynomics - key trends

- Trends and Countertrends - Futurist Tools to help predict future

- Take Hold of Your Future - be Futurewise - strategies for growth

- How to grow your business targeting demographics - impact on growth strategy - VIDEO

- Truth about the Global Economc Crisis 2007-15 - looking back from year 2100

- Future Inflation or deflation? Economic Outlook Europe / US

- Future of the Euro crisis in Greece, Ireland. Italy, Spain, Portugal. Eurozone impact.

- Future of the global economy after 'reset' May 2009

- Globalisation: Mergers and Demergers Chaos

- Future of Euro Zone Euro break up. Crisis and what next

Thanks for promoting with Facebook LIKE or Tweet. Really interested to read your views. Post below.

Futurist Keynote Speaker - New

- THIS IS YOUR FUTURE: Greatest Megatrend of All is 1 billion children alive today, 85% in emerging markets. What they do, how they live, their hopes and dreams will shape the next 50 years. And 1 billion adults will migrate to cities in the next 30 years

- AI impact on MedTech, BioTech, Health Care innovation. Why AI could drive $50bn a year sales. Dr Patrick Dixon is a Futurist Keynote Speaker, worked with many of world's largest BioTech and MedTech companies. BESTSELLER AI BOOK

- TRUTH about US trade War - what next? Why markets and voters more powerful than any US President. How chaos will resolve and likely end result. Patrick Dixon is global keynote speaker on economy and geopolitics

- Truth about US trade chaos. How Tarrifs will settle and why. Power of global markets and megatrends greater than any President. Comment after keynote at Logistics World in Mexico. Futurist Keynote Speaker

- How US trade tariff chaos will settle and why - impact on US economy, Mexico, Canada, EU and other regions. Comment after Mexico Keynote at Logistics World. Futurist Keynote Speaker

- Beyond Chaos - how to survive and thrive. What next for global trade, tariffs, Russian war, other geopolitical risks and the global economy. Futurist Keynote Speaker

- How to give world-class presentations. Keys to great keynotes. How to communicate better and win audiences over. Expert coaching for CEOs, Executives, keynote speakers – via Zoom or face to face. Patrick Dixon is one of the world's best keynote speakers

- Future of the Auto Industry: Why Our World Needs Low Cost Chinese e-vehicles. Impact of China electric cars on US and EU auto industry. Sustainability and GreenTech innovation keynote speaker

- Daily Telegraph:"If you need to acquire instant AI mastery in time for your next board meeting, Dixon’s your man. Over two dozen chapters. Business types will enjoy Dixon's meticulous lists and his willingness to argue both sides." BUY AI BOOK NOW

- Interview: How AI Will Change Your Life - BESTSELLER 12 MONTHS airports globally. Bk author Patrick Dixon, keynote speaker on AI, in conversation with Alison Jones, Extraordinary Business Book Club. Looking for a keynote speaker on AI? BOOK AI Keynote NOW

- Impact of AI on $10tn PA food and beverage sales (F&B), fast moving consumer goods (FMCG). Why trust and emotion matter in an AI-influenced retail world. Extract Ch16 BESTSELLER book: How AI will Change Your Life - Patrick Dixon Futurist Keynote Speaker

- AI in Government. Impact of AI on state departments, AI efficiency, AI cost-saving. AI policy decisions and global regulation of AI. Extract Ch26 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on insurance and AI

- AI warfare: AI in future conflicts. Battlefield AI, impact of AI on defence, military budgets, AI hybrid weapons, armed forces strategy. Extract Ch25 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on Defence and AI

- AI will create HUGE new cybersecurity risks, hijacked by criminals and rogue states. Paralysis of companies, hospitals, governments. Extract Ch23 BESTSELLER book: How AI will Change Your Life - Patrick Dixon, keynote speaker - cybersecurity and AI

- AI for Insurance: how AI will impact AI in underwriting, quotes, re-insurance. AI will improve claims handling, AI reducing fraud. Extract Ch22 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on insurance and AI

- How AI will impact banks: AI will save bank core costs, deliver better banking services, but AI will also create huge new banking risks. Extract Ch22 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on banking and AI

- AI Investing, AI in Fund Management, Pension Funds, AI trading in Stock Markets and Global Financial Services AI, Banking AI. Extract Ch21 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on Fund Management AI

- How AI will double digital energy consumption globally in 10 years. AI will have huge impact on energy, environment, sustainability. Extract Ch20 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on sustainable AI

- AI in Construction - future Impact of AI on built environment. Buildings design, architecture, site development, AI in smart cities. Extract Ch19 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI in construction

- Manufacturing AI. How AI will transform factories and manufacturing, including AI logistics and AI-driven supply chain management. Extract Ch18 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI in manufacturing

- AI impact on travel, tourism AI, transport AI, auto industry AI, aviation AI, airlines. How AI will change the travel experience.Extract Ch14 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI for travel industry

- Future of retail AI: impact on retail sales, retail marketing, customer choice, AI predicts demand, AI warehouse, AI supply chains.Extract Ch13 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI retail trends

- Future Marketing: Impact of AI on Marketing - how AI will transform marketing, AI trends in advertising. Extract from Ch12 BESTSELLING BOOK AIRPORTS IN GLOBALLY: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI marketing

- Impact of AI on search engines, what AI means for news sites, AI in social media, AI in publishing and AI art copyright. Extract Ch11 - BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker

- Future of Music Industry: AI impact on music, musicians, record labels, AI composing, AI lyrics, AI copyright violations. AI for song-writers, singers, album producers.Extract Ch10 BESTSELLER bk How AI will change your life - Patrick Dixon Keynote Speaker

- Future Film, TV, Media, video games - impact of AI on film-making, AI movies, AI in studios, post-production AI, computer games.Extract Ch10 BESTSELLER book How AI will Change Your Life - by Patrick Dixon, AI keynote speaker on film industry, TV and media

- Impact of AI on software development, programming, high level coding, AI system design, and AI strategy. Extract Ch9 BESTSELLER new book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker on software and IT strategy / design

- Impact of AI on adult education.Teaching entire nations how to tell what is true v fake news, AI scams or false consipiracy theories. Extract Ch9 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker on education

- Future of Education - Impact of AI on Teaching, Schools and Colleges. Why AI will force radical changes in teaching curriculum and methods. Extract Ch7 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker on education

- Impact of AI on Pharma, Drug Discovery, Drug Development and Clinical Trials.10m lives Will Be Saved A Year Globally Because Of AI In Pharma and Health. Extract Ch6 BESTSELLER BOOK How AI Will Change Your Life. Dr Patrick Dixon, Pharma AI Keynote Speaker

- How health care, hospitals and community care will be impacted by AI. 10 million lives will be saved a year globally because of AI in health. Extract Ch5 BESTSELLER book: How AI will Change Your Life - Dr Patrick Dixon, health and AI keynote speaker

- How will AI impact office workers, teams and working from home (WFH)? Lessons for every team leader, manager and leader on AI impact at work. Extract from Chapter 4 How AI will Change Your Life by Patrick Dixon, AI keynote speaker. BESTSELLER LIST 11mths

- Why AI will result in MORE JOBS. Myth of global job destruction from AI due to net job creation. How will AI impact the workplace and work itself? Extract Ch3 BESTSELLER book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker

- Super-Smart AI and a Reality Check. How Super-smart AI will become conscious, posing all kinds of new Super AI / AGI risks to future humanity. Extract Chapter 2 BESTSELLER Book: How AI Will Change Your Life - by Patrick Dixon, AI keynote speaker

- The TRUTH about AI / Artificial Intelligence. What is REALLY happening and why this matters now for your personal life, job and wider world. Extract Ch1 book: How AI will Change Your Life by Patrick Dixon, AI keynote speaker. BESTSELLER LIST 11 MTHS

- Impact of AI on Health Care and Pharma – Artificial intelligence keynote outline for Pharma companies and health care organisations. How will AI drive future AI innovation in health and Pharma?

- How AI will change your life - BESTSELLER book, out NOW A Futurist's guide to a super-smart world. 28 chapters on impact of AI in industry, government, company, personal lives. Patrick Dixon is a world leading keynote speaker on AI. CALL +44 7768511390

- Risk of Russia war with NATO. Russia's past is key to it's military future. War and Russian economy, Russian foreign policy and political aspirations, future relationship between Russia, China, EU, NATO and America - geopolitical risks keynote speaker

- Over 2 million have watched my Green Energy Webinar! "Next 20 years will determine future of humanity": predictions for 40 years. Massive scaling green tech. Race for solar, wind v coal, oil, gas. Climate emergency. Futurist Keynote for Enel Green Power

- How AI / Artificial Intelligence will transform every industry and nation - banking, insurance, retail, manufacturing, travel and leisure, health care, marketing and so on - What AI thinks about the future of AI? Threats from AI? Keynote speaker

- The Future of AI keynote speaker. Will AI destroy the world? Truth about AI risks and benefits. (Some of this AI post written by AI ChatGPT - does it matter?). Impact of AI on security, privacy AI, defence AI, government AI - keynote speaker

- Future of Rail in 2030: trends in rail passengers, rail freight, railway innovation. High speed rail, impact on aviation. Rail logistics and supply chain management. AI impact, Zero carbon hydrogen powered railway locomotives - Rail Trends Keynote

- Future of the Auto Industry 2040. Trends impacting the auto industry, car manufacturers, truck factories. Auto industry innovation, autonomous vehicles, flying cars, vehicle ownership, car insurance AI / Artificial Intelligence.Futurist Keynote for Belron

- Future of Aviation: Carbon Zero Planes. New fuels such as hydrogen, smaller short distance battery powered vertical take-off vehicles. Why Sustainable Aviation Fuel is not the answer to global warming. 100s of innovations such as AI will impact aviation

- THE TRUTH ABOUT FUTURE MASS MIGRATION - a people movement with greater force than any military superpower. As I predicted in "Futurewise" (1998-2005), large scale migration is now unstoppable, able to break governments, yet many nations NEED migration

Popular - Futurist Speaker

- Futurist Speakers: How keynote by Patrick Dixon will transform your event. Visionary, high impact, high energy, entertaining Futurist keynotes on future trends. Keynotes on AI, tech, health, marketing, manufacturing etc. 370,000 reads. CALL +44 7768511390

- Futurist Keynote Speaker Website - Sorry - something has gone wrong! We will check it out...

- Conference Speakers: How Great Conference Speakers Change Lives. 10 tests BEFORE booking top conference speakers. Keys to world-class events. Secrets of ALL best keynote speakers. Who are best keynote speakers in world? 327,000 reads. CALL +44 7768511390

- Future of Marketing 2030 - Marketing Videos, key marketing trends and impact of AI on marketing campaigns. Conference Keynote Speaker on Marketing - 234,000 have read this post. Marketing Keynote Speaker: CALL NOW +44 7768 511390

- The Future of Outsourcing in world beyond AI - Impact on Jobs - Futurist keynote speaker on opportunities and risks from outsourcing / offshoring. Why many jobs coming home (reshoring - shorter supply chains). AI and new risk, higher agility. 200000 views

- The Truth About Drugs - free book by Dr Patrick Dixon - research on drug dependency, addiction and impact on society of illegal drugs

- Future of Stem Cell Research - Creating New organs and repairing old ones. Trends in Regenerative Medicine, anti-ageing research, AI. Future pharma, clinical trials, medical research, heath care trends, and biotech innovation.Health care keynote speaker

- Future of the European Union - Enlarged or Broken? What direction for the EU over the next two decades? Geopolitics keynote speaker

- The Truth About Westminster

- 10 trends that will really DOMINATE our future - all predictable, changing slowly with huge future impact - based on book The Future of Almost Everything by world-renowned Futurist keynote speaker. Over 100,000 views of this post. Discover your future!

- The Truth about AIDS

- Future of the Automotive Industry (Auto Trends) - e-cars, lorries, trucks and road transport trends, reducing CO2 emissions, e-cars, eVTOL flying vehicles, hydrogen, autonomous AI drivers, auto industry impact from AI. Futurist keynote speaker

- Marketing to Older Consumers - 1.4 billion over 60 year old consumers by 2030. Future of Marketing Keynote Speaker. Ageing customers, strategies to target older consumers and other marketing trends. Why many companies fail in marketing to older people

- Future of Aviation Industry. Rapid bounce back after COVID AS I PREDICTED. Most airlines and airports were unprepared for recovery. Aviation keynote Speaker. Fuel efficiency, reducing CO2, hydrogen fuel, AI, zero carbon, flying taxis (eVTOL)

- Sustainagility: innovation will help save world. Sustainable business keynote speaker

- China as world's dominant superpower - Impact on America, Russia and EU. Futurist keynote speaker on global economy, emerging markets, geopolitics and major market trends

- Patrick Dixon Futurist Keynote Speaker - ranked one of top 20 most influential business thinkers, Chairman Global Change Ltd, Author 18 Futurist books. Call now to discuss a Transformational Futurist Keynote for Your Event: +44 7768 511390

- Web Traffic: Up to 2.9 million pages a month - Future Trends website of Patrick Dixon, Futurist Keynote Speaker

- Futurist Keynote Speakers. 20 secrets of world's best keynote speakers. How to select great keynote speakers for your events. Secrets of all top keynote speakers. Change how people see, think, feel and behave. Who are the best? CALL +44 77678 511390

- Total media audience >450 million on TV, Radio, Press Coverage of Patrick Dixon, Futurist Keynote Speaker - Call Patrick Dixon NOW for media interviews (or for event keynotes) on +44 7768 511390.